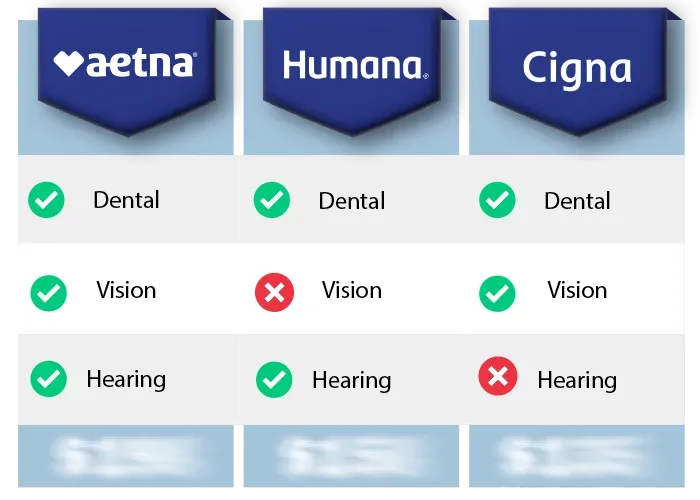

Best Supplemental Medicare Plans: Navigating Your Options in 2023

Best Supplemental Medicare Plans: Navigating Your Options in 2023

Introduction

As the healthcare landscape evolves, understanding the best supplemental Medicare plans becomes crucial for those looking to maximize their coverage. Supplemental Medicare, often referred to as Medigap, offers a safety net against out-of-pocket costs not covered by Original Medicare. This article delves into the intricacies of these plans, providing a comprehensive look at the top options available in 2023.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, commonly known as Medigap, is a private insurance plan designed to complement Original Medicare. It assists beneficiaries by covering some out-of-pocket costs, including copayments, coinsurance, and deductibles. By integrating Medigap with Original Medicare, beneficiaries can significantly reduce their healthcare expenses.

How Does Medicare Supplement Insurance Work?

Once enrolled in Original Medicare (Part A and Part B), beneficiaries might face certain out-of-pocket expenses. For instance, before Medicare Part B starts covering some care costs, beneficiaries must meet a deductible ($226 in 2023). Even after meeting this deductible, a 20 percent Part B coinsurance typically applies to approved services. Medigap plans can help cover these additional costs, offering beneficiaries more financial security.

Coverage Offered by Medicare Supplement Insurance

Medigap plans can cover a variety of costs, including:

Medicare Part A and B coinsurance

Part A and B deductibles

Part B excess charges

First three pints of blood for transfusions

Skilled nursing facility coinsurance

Hospice care coinsurance

Emergency care received outside the U.S.

There are ten standardized Medigap plans available in most states, each labeled with a letter (A, B, C, D, F, G, K, L, M, N). Each plan offers a unique combination of the above coverages, ensuring that beneficiaries can find a plan tailored to their needs.

Cost of Medicare Supplement Insurance

The cost of Medigap plans varies based on several factors:

Coverage level of the plan

Use of medical underwriting during the application

Age at enrollment

Eligibility for carrier discounts

Gender

It's essential to compare different plans and providers to find the most cost-effective option for your needs.

Medigap Eligibility and Enrollment

To be eligible for Medigap, one must be at least 65 years old, enrolled in Medicare Parts A and B, and reside in the plan's service area. Some states also offer Medigap plans to beneficiaries under 65. The best time to enroll in a Medigap plan is during the six-month Medigap Open Enrollment Period, which starts when you turn 65 and are enrolled in Part A and B. During this period, insurance companies cannot use medical underwriting, ensuring that beneficiaries get the best rates regardless of health status.

Key Takeaways

Medigap plans offer crucial coverage for out-of-pocket Medicare costs.

There are ten standardized Medigap plans, each with unique coverage options.

Costs vary based on coverage, location, and other factors.

The best time to enroll is during the Medigap Open Enrollment Period.

Conclusion

Navigating the world of supplemental Medicare plans can be daunting. However, with the right information and a clear understanding of your needs, you can find the perfect plan to complement your Original Medicare coverage. By considering the options and understanding the nuances of Medigap, you can ensure comprehensive coverage and peace of mind as you navigate your healthcare journey.

Copyright © 2025 Senior Benefits Guide All Rights Reserved.

204 Church St Suite 1A, Boonton NJ 07005

Disclaimer: This website is not affiliated with the Medicare/Medicaid program or any other government entity. The information provided on this website is for informational purposes only. It is not intended to be, nor does it constitute any kind of financial advice. Please seek advice from a qualified professional prior to making any financial decisions based on the information provided. This website acts as an independent digital media & advertising publisher. This webpage is formatted as an advertorial. An advertorial is an advertisement that is written in an editorial news format. PLEASE BE AWARE THAT THIS IS AN ADVERTISEMENT AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE. This website MAY RECEIVE PAID COMPENSATION FOR CLICKS OR SALES PRODUCED FROM THE CONTENT FOUND ON THIS WEBPAGE. This compensation may affect which companies are displayed, the placement of advertisements, and their order of appearance. Any information, discounts, or price quotations listed may not be applicable in your location or if certain requirements are not met. Additionally, our advertisers may have additional qualification requirements.

Our goal is to provide exceptional service. One of our agents may reach out to you to discuss your order, ask for feedback, and/or see if you need any assistance with your products, services, or plans, at the phone number you provided regardless of your do-not-call list status. You may opt-out of further contact at any time by simply telling our customer service team that you would no longer like to be contacted. In the event that our team is unable to reach you by phone, they may send you a text message letting you know that we called. Both our text messages and phone calls may be sent or connected utilizing automated software. Carrier charges may apply. You may opt-out of any future contact via text message by replying anytime with "STOP".

Copyright © 2025 All Rights Reserved.

Find Medicare Advantage Plans in 3 Easy Steps