Medicare Supplement Insurance Advantage: Choosing the Right Coverage for Seniors

Medicare Supplement Insurance Advantage: Choosing the Right Coverage for Seniors

Medicare plays a crucial role in providing health care to seniors, covering a broad range of medical services. However, navigating the maze of Medicare, Medicare Supplement Insurance, and Medicare Advantage plans can be challenging. This article aims to clarify the differences and benefits of Medicare Supplement Insurance and Medicare Advantage plans, assisting seniors in making informed decisions about their health care coverage.

Understanding Medicare Supplement Insurance (Medigap)

Medicare Supplement Insurance, commonly known as Medigap, is designed to cover gaps in coverage that Original Medicare does not cover, including copayments, deductibles, and coinsurance.

Key Features of Medigap:

Coverage: Medigap plans help cover the out-of-pocket costs that Original Medicare does not pay.

Enrollment: To enroll in a Medigap plan, you must have Medicare Part A and Part B.

Plan Options: There are ten standardized Medigap plans available in most states, each labeled with a different letter that offers varying levels of coverage.

No Network Restrictions: Medigap plans allow you to see any doctor or provider that accepts Medicare, without network restrictions.

Exploring Medicare Advantage (Part C)

Medicare Advantage, also known as Part C, is an alternative to Original Medicare that offers an all-in-one bundle plan that typically includes Parts A, B, and often Part D (prescription drug) coverage.

Key Features of Medicare Advantage:

Provider Networks: Medicare Advantage plans usually have network restrictions, meaning you must use healthcare providers and facilities within the plan’s network.

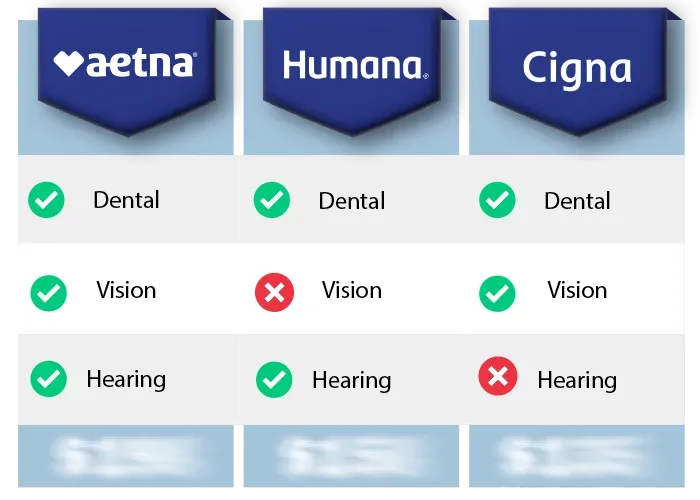

Additional Benefits: These plans often offer additional benefits, such as dental, vision, and hearing care, not covered by Original Medicare.

Cost Structure: While these plans might have lower or $0 premiums, they could have higher out-of-pocket costs when you receive medical care.

Annual Changes: Plan features and provider networks can change annually, so it’s important to review your plan each year during the enrollment period.

Comparing Medigap and Medicare Advantage

Understanding the differences between Medigap and Medicare Advantage is essential for choosing the best health coverage to meet your needs. Here are some critical distinctions:

Flexibility and Freedom

Medigap: Offers more freedom in choosing healthcare providers nationwide that accept Medicare.

Medicare Advantage: Limits coverage to a network of local providers and hospitals, although it often costs less in premiums.

Coverage and Costs

Medigap: Covers the copays, coinsurance, and deductibles that Medicare does not, potentially leading to higher premium costs but lower overall out-of-pocket expenses.

Medicare Advantage: Might cover additional services like dental and vision, but you may pay more out of pocket when you receive treatment.

Travel

Medigap: Ideal for those who travel frequently within the U.S., as it covers any provider that accepts Medicare.

Medicare Advantage: Coverage is typically restricted to a specific geographic area, which might be problematic for frequent travelers.

Choosing the Right Plan

Selecting the right Medicare coverage involves considering your health needs, lifestyle, and financial situation. Here are a few tips:

Assess Your Health Needs: Consider your typical health care usage, including any regular medications, to determine which plan type might offer the most beneficial coverage.

Calculate Total Costs: Look beyond just premiums—consider deductibles, copayments, coinsurance, and out-of-pocket maximums.

Consider Your Travel Habits: If you travel often, a Medigap plan may be more advantageous.

Review Annually: Both health needs and plan coverages change, so review your options annually during the open enrollment period.

Conclusion

Choosing between Medicare Supplement Insurance and Medicare Advantage requires careful consideration of your health care needs, financial ability, and lifestyle preferences. By understanding the key features and differences between these options, seniors can better manage their health care coverage and ensure they are fully protected.

Copyright © 2025 Senior Benefits Guide All Rights Reserved.

204 Church St Suite 1A, Boonton NJ 07005

Disclaimer: This website is not affiliated with the Medicare/Medicaid program or any other government entity. The information provided on this website is for informational purposes only. It is not intended to be, nor does it constitute any kind of financial advice. Please seek advice from a qualified professional prior to making any financial decisions based on the information provided. This website acts as an independent digital media & advertising publisher. This webpage is formatted as an advertorial. An advertorial is an advertisement that is written in an editorial news format. PLEASE BE AWARE THAT THIS IS AN ADVERTISEMENT AND NOT AN ACTUAL NEWS ARTICLE, BLOG, OR CONSUMER PROTECTION UPDATE. This website MAY RECEIVE PAID COMPENSATION FOR CLICKS OR SALES PRODUCED FROM THE CONTENT FOUND ON THIS WEBPAGE. This compensation may affect which companies are displayed, the placement of advertisements, and their order of appearance. Any information, discounts, or price quotations listed may not be applicable in your location or if certain requirements are not met. Additionally, our advertisers may have additional qualification requirements.

Our goal is to provide exceptional service. One of our agents may reach out to you to discuss your order, ask for feedback, and/or see if you need any assistance with your products, services, or plans, at the phone number you provided regardless of your do-not-call list status. You may opt-out of further contact at any time by simply telling our customer service team that you would no longer like to be contacted. In the event that our team is unable to reach you by phone, they may send you a text message letting you know that we called. Both our text messages and phone calls may be sent or connected utilizing automated software. Carrier charges may apply. You may opt-out of any future contact via text message by replying anytime with "STOP".

Copyright © 2025 All Rights Reserved.

Find Medicare Advantage Plans in 3 Easy Steps